Natural ingredients have multifaceted applications in many growing industries such as pharmaceuticals, food, personal healthcare, cosmetics and obviously Nutraceutical. Applications of these ingredients could be at different levels. They could be at active ingredient level, excipients level, additives level or applied in flavors and colors.

Multiple Industries: The scope for natural ingredients is wide and can be applied at multiple levels. In fact, pharmaceutical industry is getting integrated through natural and nutraceutical ingredients in mainstream of their business as the business is changing towards health. In case of pharmaceuticals, natural ingredients like amino acids, polysorbate, vitamin and mineral mix, herbal extracts, vegetable extracts, enzymes, slimming agents, joint health improving agents, etc. are consumed at different levels. In case of Vit E you would observe its usage and applicability of in multiple industries.

Fig 1: Multifaceted Vit E

Food Industry: In case of food industry production and consumption of range of package foods and beverages are catching up the market share, use of many ingredients as emulsifiers, sweeteners, flavors and food enhancers, and preservatives would increase. As emulsifiers, lactose and lactose syrup, molasses, seaweed extracts, pectin and starches, tapioca, sago, arrowroot starch, rosin products, chickpeas and broad & horse beans, kidney beans, onions, tomatoes, garlic, carrots and olives, vegetable saps and extracts are showing good growth. Flavoring agents in beverages, dairy products, bakery, savory and convenience foods will need to abide by the new rules. The worldwide emulsifier industry was expected to exceed a volume of 2.5 million metric tons in 2017. Emulsifiers are used not only in food and beverage products but also in the personal care industry. Consumers are readily opting for natural emulsifiers. The market is also being driven by the trend of fat replacement in food products and product innovation.

Personal Healthcare Industry: In personal healthcare industry natural, organic and Ayurvedic ingredients are preferred in different types of formulations. As per Nielsen report (2017), consumption of such ingredients is growing fast as much as 1.7 times. Applications at active ingredient level are more predominant in personal care products in comparison to other level of applications in various industries. This industry is expanding beyond moisturizing agents and sun protection to anti-pollutant and antioxidant protection. Globally many active ingredients are getting replaced by natural ingredients as the evidence and science behind these ingredients is getting available at efficacy level as well as this makes a lot of sense at commercial level also. In Indian context market is getting developed in I, II, III tiers cities.

Cosmetics Industry: In cosmetic industry the preference for natural ingredients is particularly strong among consumers, who have been exposed to traditional Ayurvedic and Chinese medicines. As most of the cosmetic products are changing their market definition to skin health and other appropriate domains, there is need for replacing synthetic ingredients and also preventive agents as many are looking for natural, active as well as preventive agents. As a result, there is a need for developing R&D, product development, rigor of regulatory needs such as human studies, clinical trials expertise in cosmetics and also overall skin care and ageing market.

Nutraceuticals Industry: In case of Nutraceuticals industry, besides food and beverages, functional foods and dietary supplements take major charge of applications as well as consumption. Processed foods and beverages like cereals, soups, food fortifiers, fortified juices and other similar products have direct consumption as active ingredients of Nutraceutical ingredients.

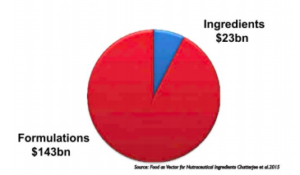

Fig:2 Global Nutraceuticals Market

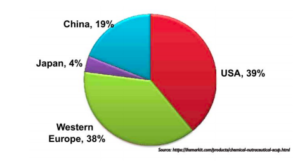

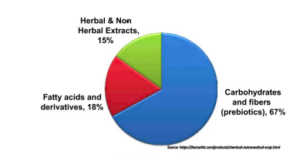

Formulations market has dependence on Nutraceutical ingredients which was amounted to USD 25 bn in 2015 to the tune of almost 15-20% of its total formulations and as the formulations grow role of ingredient with its growth would further increase. USA and Western Europe account for 77% of the total volume and China and Japan are following the trend, the ingredients are also traversing in the same direction. Probiotics and fatty acids derivatives dominate this market along with herbal and non-herbal extracts.

Along with these, other ingredients like Asthaxanthin, Polyphenols from pomegranate, Glutathione and extracts of

Fig 3: County_wise Dominance

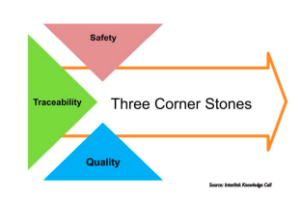

In case of such extracts high technology places a very important role in maintaining quality, safety and traceability as these are the two major corner stones in making ingredients further grow in this domain as well as in other industry domain.

Fig 4: Share of Nutraceutical ingredients

Innovations: Obviously, innovations which will improve bioavailability and also novel delivery system would further improve the differentiating factors for industry. From industry point of view the demand for right mix of different ingredients is also becoming more common as it becomes convenient for manufacturers to provide desire level quantity in safety, quality and traceability.

Fig 5: Three Corner Stone

IoT: Other way of looking at these applications and consumptions, primary source of information could be through internet of things as you can get direct feedback from consumers through what they say on social media and other digitally powerful media.

Fig 6: Internet Thing

Recent data from Nutraceutical world reveals that, 20 key health ingredients have already made head-way in the hearts of the consumers as they reveal what they feel.

Ingredients Journey: Being a fascinated journey from creating something in the laboratory and seeing as well as visualizing its ramifications on different industries for their applications give tremendous satisfaction and perhaps this may lead to quantum jump in business for few ingredients as it has already happened for lutein, spirulina, lycopene, vanillin, as all these ingredients have grown in different dimensions. It is a right way to say that unlike pharmaceutical active ingredients, natural active ingredients can be branded as they are multi-faceted.

References:

- Nielsen report (2017)

- Interlink Knowledge Cel

- Nutraceutical ingredients, Specialty chemicals update program, IHS Markit, July 2017